India E-Invoice & E-Way Bill

Automate Your E-Invoicing & E-Way Bill Compliance with SAP Cloud ERP Integration

Ensure seamless GST compliance, real-time reporting, and faster logistics with SAT Infotech’s BTP-based automation solution for India E-Invoice and E-Way Bill.

Streamline Your GST Compliance with Automated E-Invoicing & E-Way Bill Management

SAT Infotech’s BTP extension for India E-Invoice & E-Way Bill simplifies tax compliance by automating the generation, validation, and submission of invoices and waybills directly from SAP Cloud ERP.

Integrated with the NIC and GSTN portals, it eliminates manual intervention, minimizes errors, and accelerates business operations.

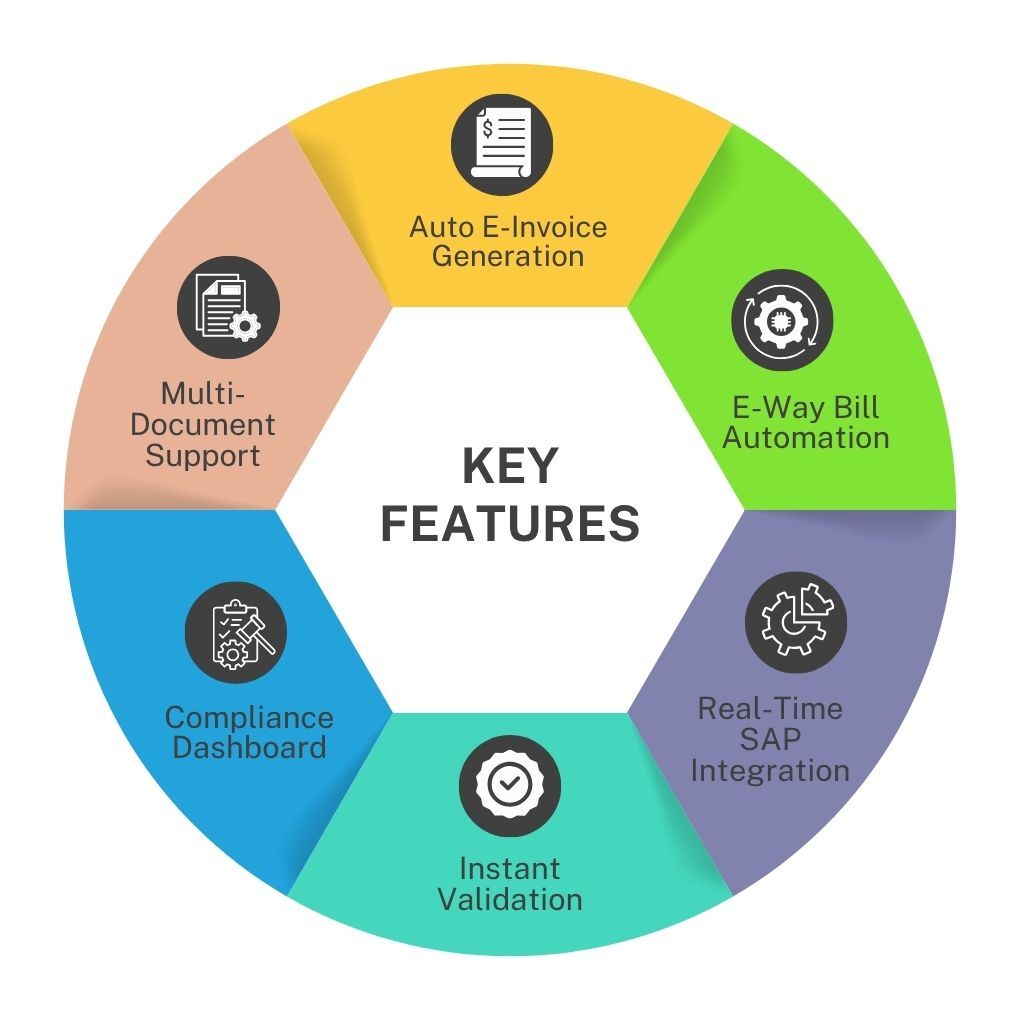

Key Features of India E-Invoice & E-Way Bill Integration

-

📄 Auto E-Invoice Generation: Direct creation of IRNs from SAP.

-

🚛 E-Way Bill Automation: Auto-generate E-Way Bills from delivery or shipment data.

-

🔗 Real-Time SAP Integration: Two-way sync between SAP and GST portals.

-

⚡ Instant Validation: Automated response from NIC APIs for faster processing.

-

📊 Compliance Dashboard: Monitor IRN status, rejection, and re-submission logs.

-

🧾 Multi-Document Support: Handles invoices, credit/debit notes, and exports.

-

🔐 Secure & Auditable: Full encryption, logging, and traceability for audits.

.png)

Why Choose SAT Infotech’s BTP Extension?

• Reduced Manual Effort: Fully automated submission and tracking.

• Real-Time Accuracy: Error-free invoice generation with auto validation.

• Compliance Ready: Always up-to-date with latest GST and NIC standards.

• Operational Efficiency: Faster turnaround for dispatches and billing.

• Seamless SAP Integration: Built and certified on SAP Business Technology Platform (BTP).

.png)

Built on SAP Business Technology Platform (BTP)

The solution leverages SAP BTP for secure, scalable, and real-time integration with your SAP S/4HANA Cloud or On-Premise system

• Connects through OData APIs

• Utilizes SAP UI5/Fiori applications for front-end

• Real-time sync with SAP MM, SD, and EWM modules

• Supports Cloud Foundry environment